Since April 2020, the S&P 500 has delivered a total return of 92.9%. But one standout stock has nearly doubled the market - over the past five years, Hims & Hers Health has surged 172% to $26.89 per share. Its momentum hasn’t stopped as it’s also gained 25.8% in the last six months thanks to its solid quarterly results, beating the S&P by 32.6%.

Is now still a good time to buy HIMS? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does HIMS Stock Spark Debate?

Originally launched with a focus on stigmatized conditions like hair loss and sexual health, Hims & Hers Health (NYSE:HIMS) operates a consumer-focused telehealth platform that connects patients with healthcare providers for prescriptions and wellness products.

Two Things to Like:

1. Customer Base Skyrockets, Fueling Growth Opportunities

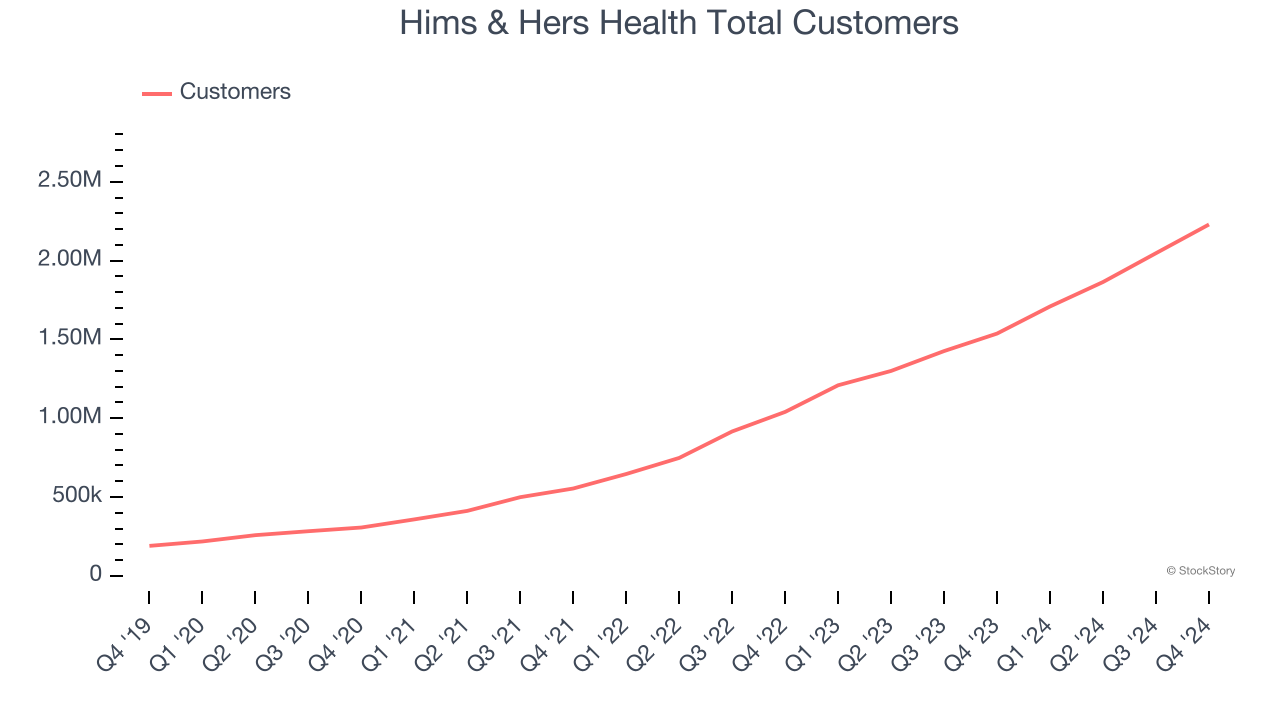

Revenue growth can be broken down into the number of customers and the average spend per customer. Both are important because an increasing customer base leads to more upselling opportunities while the revenue per customer shows how successful a company was in executing its upselling strategy.

Hims & Hers Health’s total customers punched in at 2.23 million in the latest quarter, and over the last two years, their count averaged 54.7% year-on-year growth. This performance was fantastic, reflecting its ability to "land" new contracts and potentially "expand" them later - a powerful one-two punch for sales.

2. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Hims & Hers Health’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

One Reason to be Careful:

Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Hims & Hers Health has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 7.6%, meaning management lost money while trying to expand the business.

Final Judgment

Hims & Hers Health’s positive characteristics outweigh the negatives, and with its shares beating the market recently, the stock trades at 24.9× forward price-to-earnings (or $26.89 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Hims & Hers Health

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.