IT services provider ASGN (NYSE:ASGN) announced better-than-expected revenue in Q1 CY2025, but sales fell by 7.7% year on year to $968.3 million. On the other hand, next quarter’s revenue guidance of $1 billion was less impressive, coming in 1.1% below analysts’ estimates. Its non-GAAP profit of $0.92 per share was 2.6% below analysts’ consensus estimates.

Is now the time to buy ASGN? Find out by accessing our full research report, it’s free.

ASGN (ASGN) Q1 CY2025 Highlights:

- Revenue: $968.3 million vs analyst estimates of $962.3 million (7.7% year-on-year decline, 0.6% beat)

- Adjusted EPS: $0.92 vs analyst expectations of $0.95 (2.6% miss)

- Adjusted EBITDA: $93.6 million vs analyst estimates of $94.58 million (9.7% margin, 1% miss)

- Revenue Guidance for Q2 CY2025 is $1 billion at the midpoint, below analyst estimates of $1.01 billion

- Adjusted EPS guidance for Q2 CY2025 is $1.09 at the midpoint, below analyst estimates of $1.25

- EBITDA guidance for Q2 CY2025 is $104.5 million at the midpoint, below analyst estimates of $112.5 million

- Operating Margin: 4.8%, down from 6.8% in the same quarter last year

- Free Cash Flow Margin: 0.7%, down from 6% in the same quarter last year

- Market Capitalization: $2.56 billion

Company Overview

Evolving from its roots in IT staffing to become a high-end technology consulting powerhouse, ASGN (NYSE:ASGN) provides specialized IT consulting services and staffing solutions to Fortune 1000 companies and U.S. federal government agencies.

IT Services & Consulting

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $4.02 billion in revenue over the past 12 months, ASGN is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

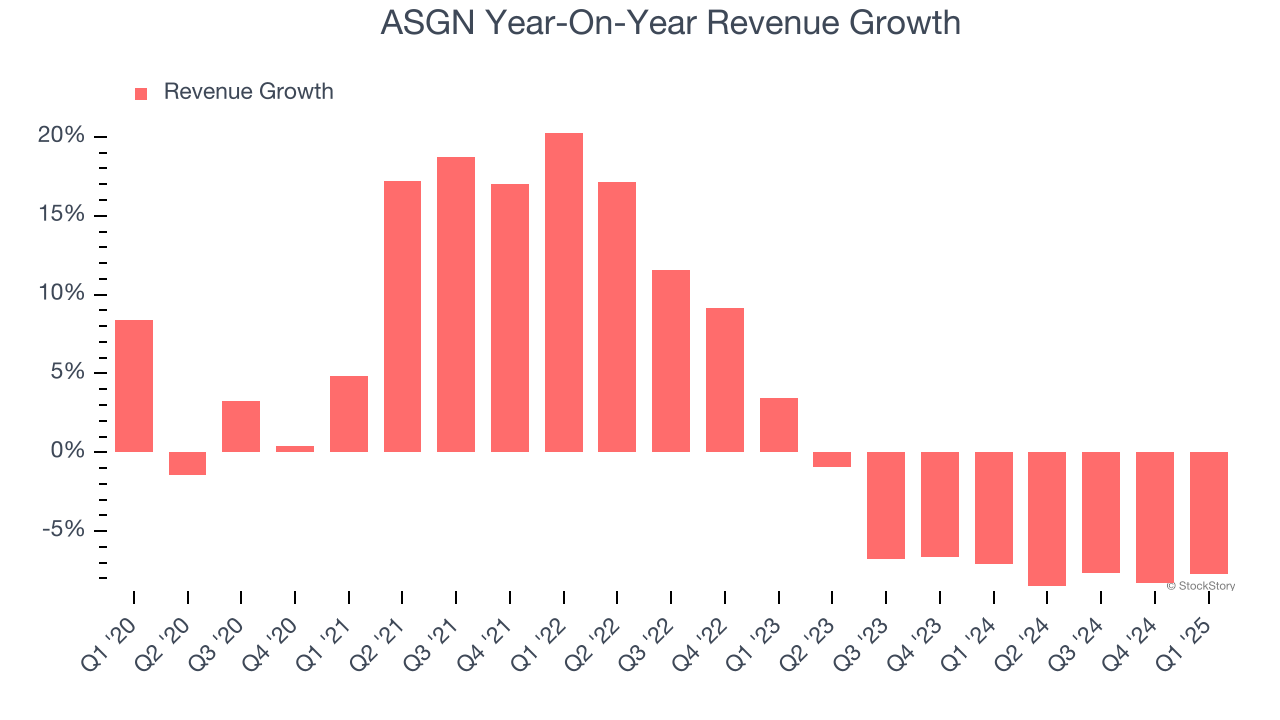

As you can see below, ASGN grew its sales at a sluggish 2.9% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. ASGN’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 6.7% annually.

This quarter, ASGN’s revenue fell by 7.7% year on year to $968.3 million but beat Wall Street’s estimates by 0.6%. Company management is currently guiding for a 3.4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

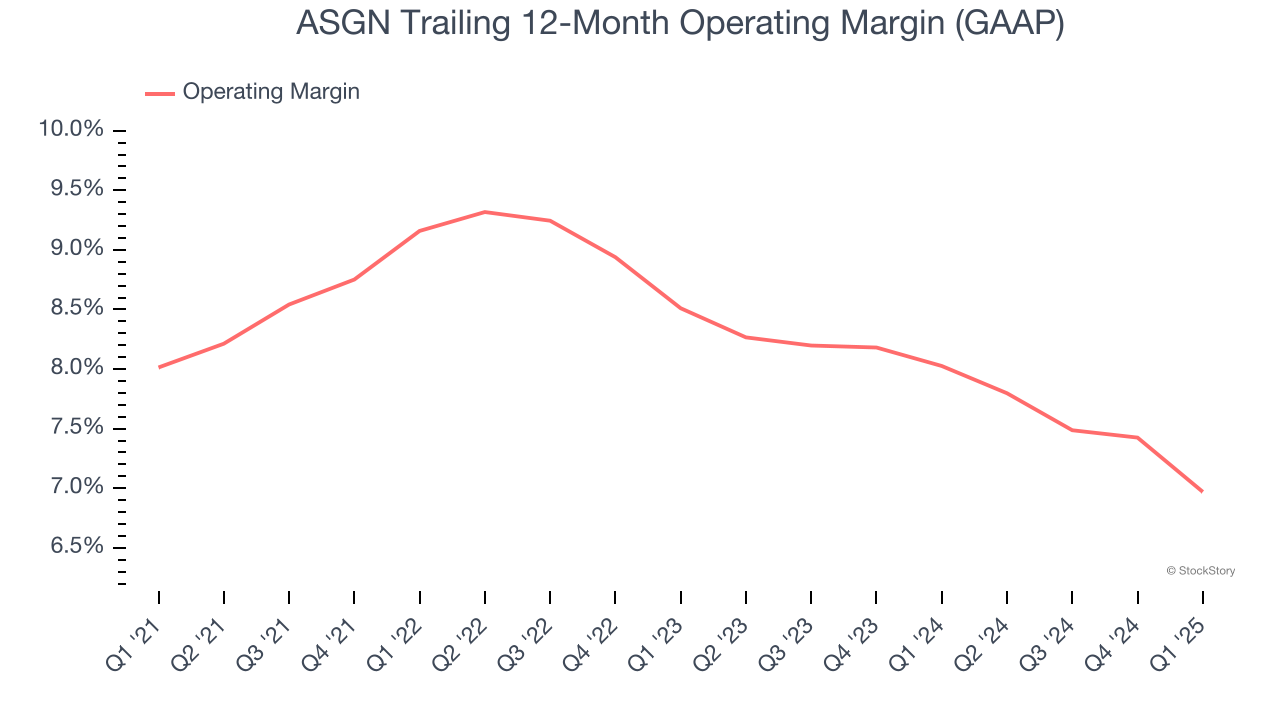

ASGN was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.2% was weak for a business services business.

Analyzing the trend in its profitability, ASGN’s operating margin decreased by 1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. ASGN’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q1, ASGN generated an operating profit margin of 4.8%, down 1.9 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

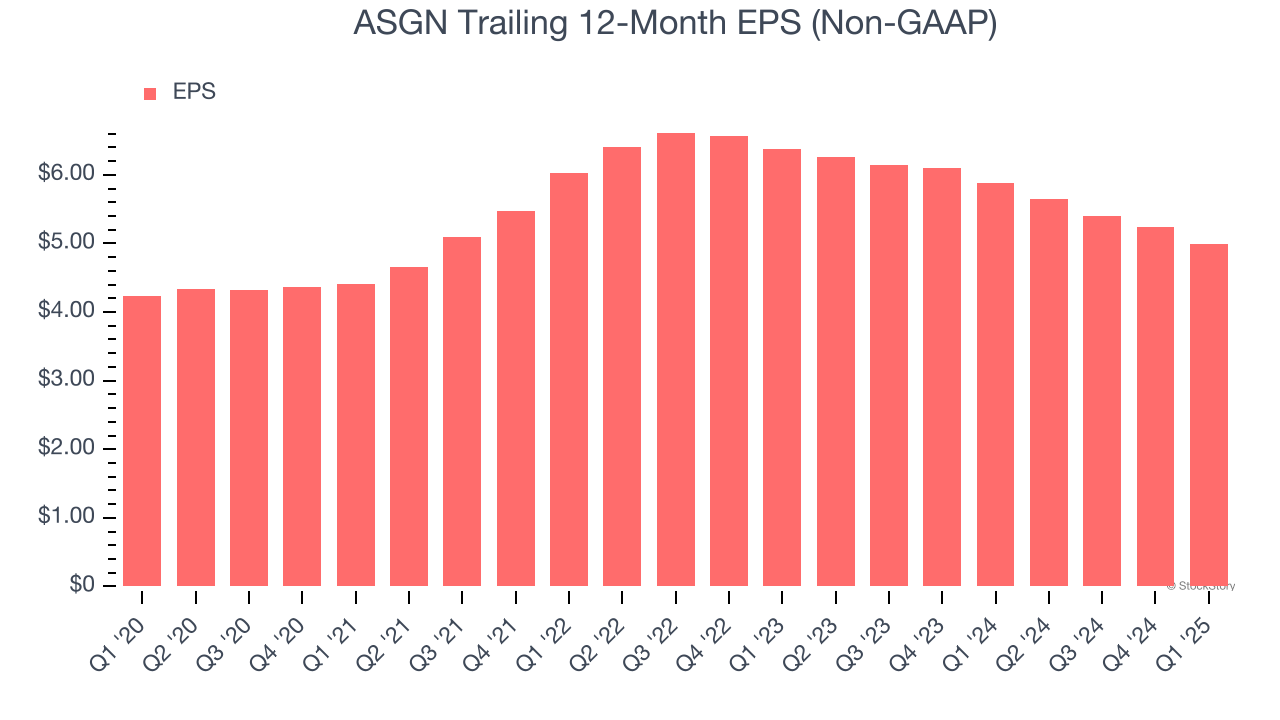

ASGN’s weak 3.3% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q1, ASGN reported EPS at $0.92, down from $1.16 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects ASGN’s full-year EPS of $4.99 to grow 1.6%.

Key Takeaways from ASGN’s Q1 Results

It was good to see ASGN narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS and EBITDA missed, and its outlook for all key financial metrics fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.9% to $56.79 immediately after reporting.

ASGN’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.