Healthcare services company Chemed Corporation (NYSE:CHE) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 9.8% year on year to $646.9 million. Its non-GAAP profit of $5.63 per share was 1.5% above analysts’ consensus estimates.

Is now the time to buy Chemed? Find out by accessing our full research report, it’s free.

Chemed (CHE) Q1 CY2025 Highlights:

- Revenue: $646.9 million vs analyst estimates of $641.8 million (9.8% year-on-year growth, 0.8% beat)

- Adjusted EPS: $5.63 vs analyst estimates of $5.55 (1.5% beat)

- Adjusted EBITDA: $121.7 million vs analyst estimates of $119.9 million (18.8% margin, 1.5% beat)

- Operating Margin: 14.6%, up from 12.3% in the same quarter last year

- Free Cash Flow Margin: 3%, down from 12.3% in the same quarter last year

- Market Capitalization: $8.47 billion

Company Overview

With a unique business model combining end-of-life care and household services, Chemed (NYSE:CHE) operates two distinct businesses: VITAS, which provides hospice care for terminally ill patients, and Roto-Rooter, which offers plumbing and water restoration services.

Senior Health, Home Health & Hospice

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

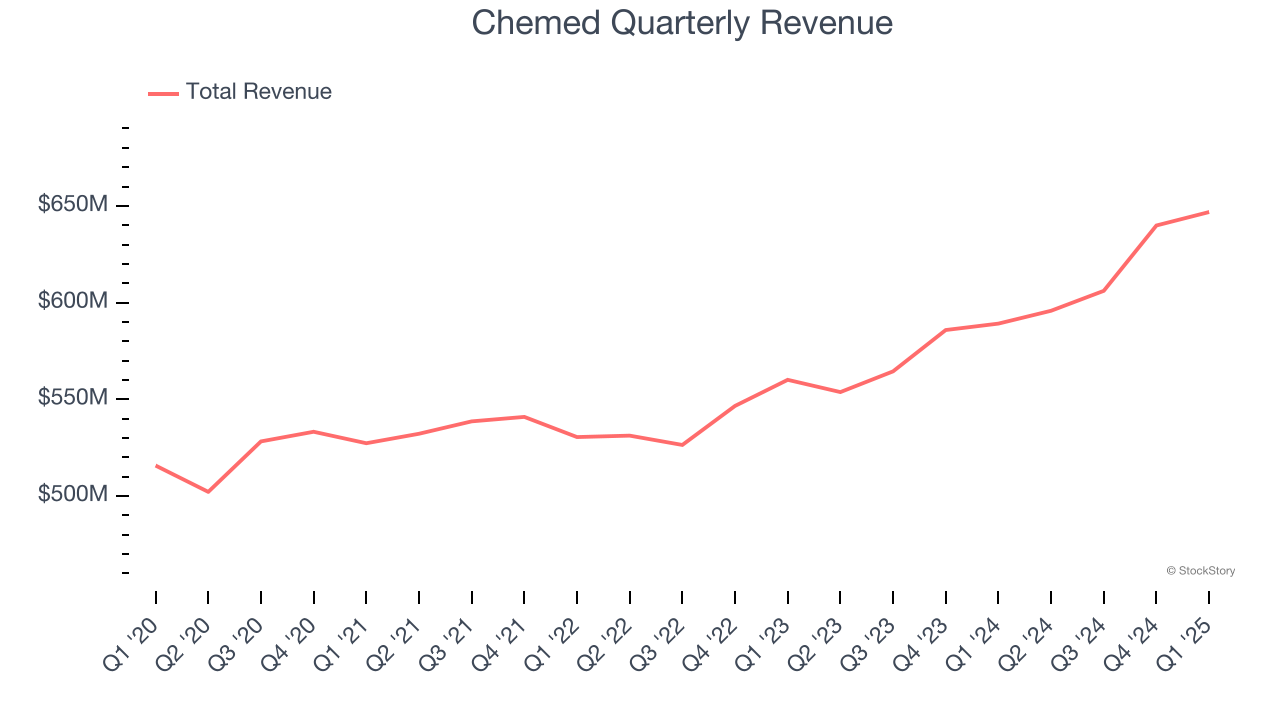

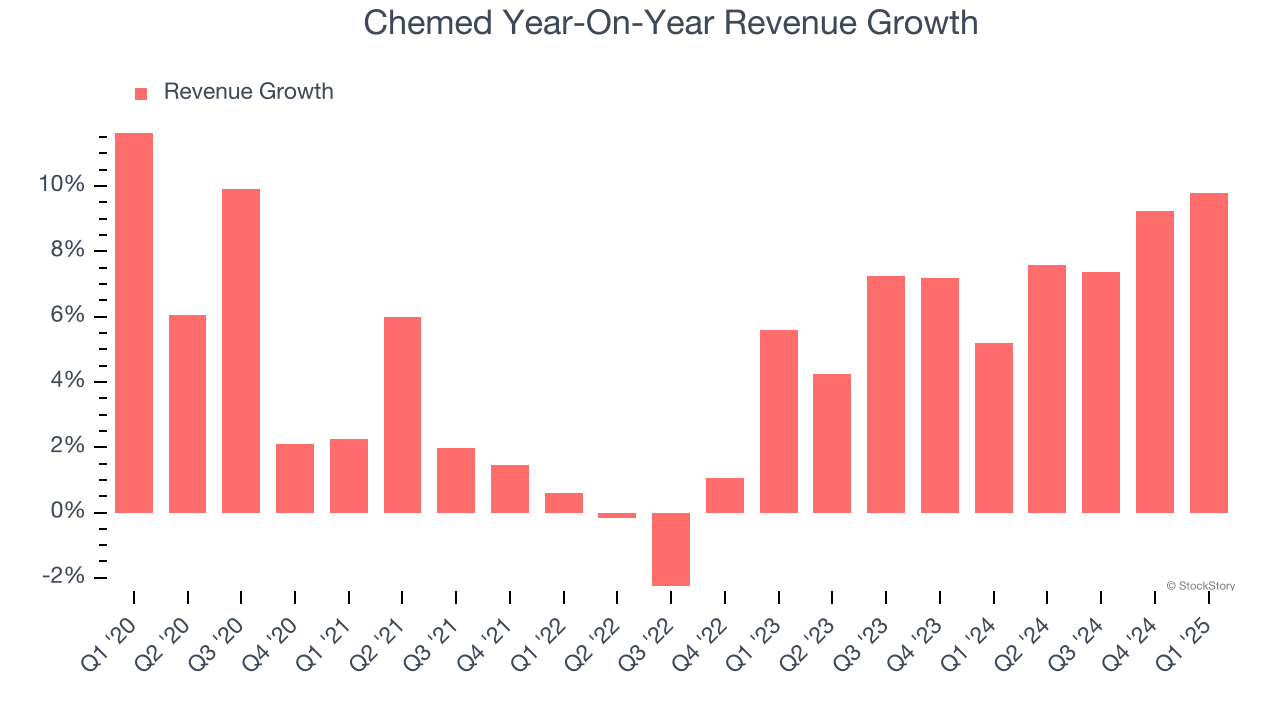

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Chemed’s sales grew at a mediocre 4.6% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Chemed’s annualized revenue growth of 7.2% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Chemed reported year-on-year revenue growth of 9.8%, and its $646.9 million of revenue exceeded Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to grow 7.2% over the next 12 months, similar to its two-year rate. This projection is above the sector average and indicates its newer products and services will help maintain its recent top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

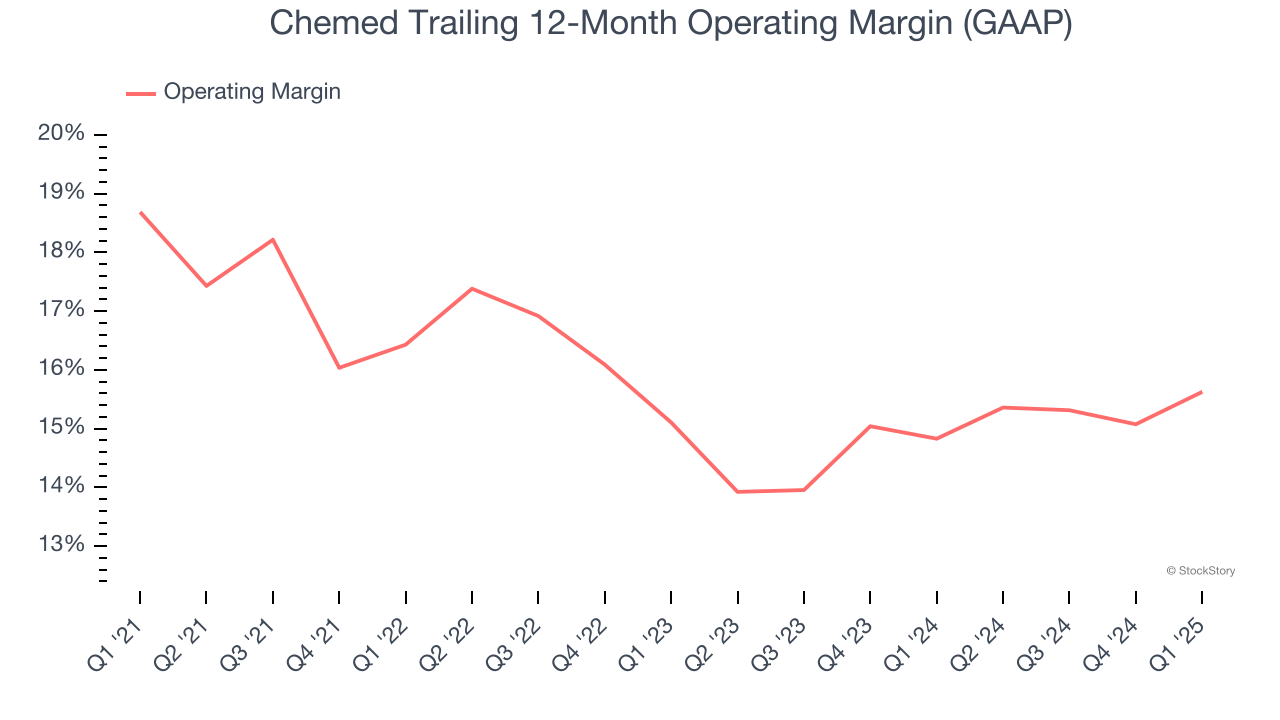

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Chemed has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 16.1%.

Looking at the trend in its profitability, Chemed’s operating margin decreased by 3.1 percentage points over the last five years. A silver lining is that on a two-year basis, its margin has stabilized. Still, shareholders will want to see Chemed become more profitable in the future.

In Q1, Chemed generated an operating profit margin of 14.6%, up 2.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

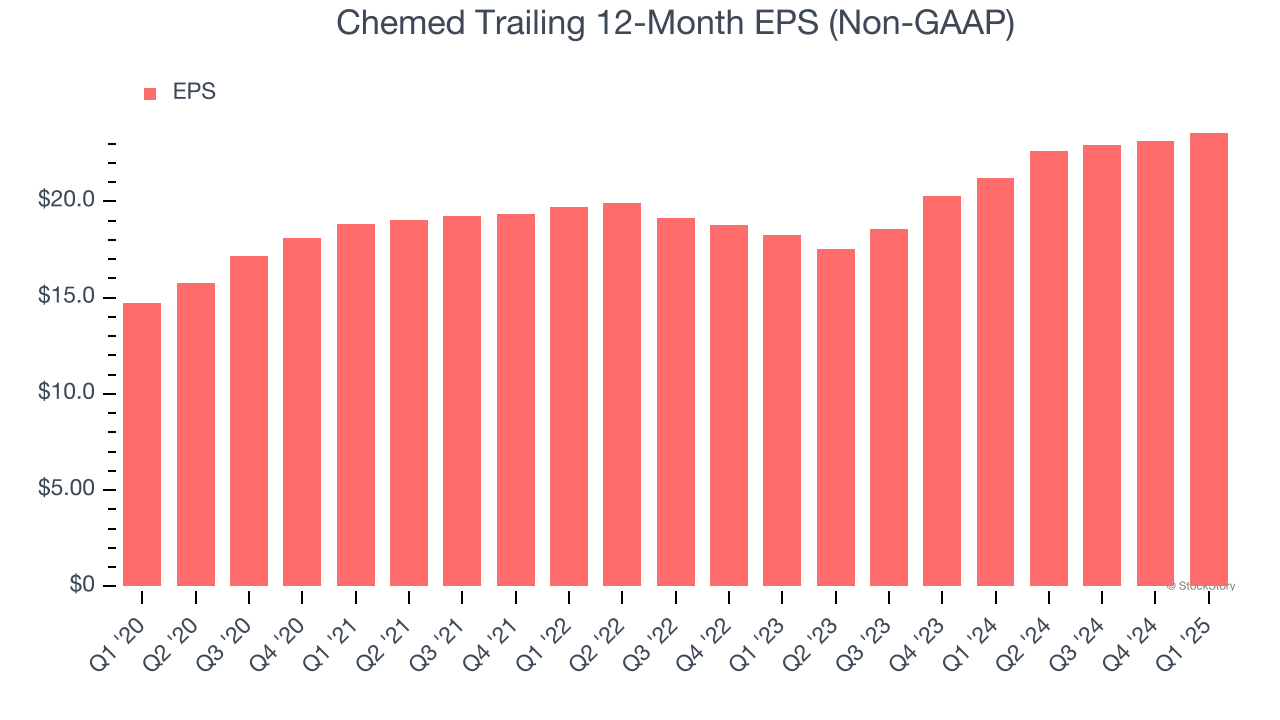

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Chemed’s EPS grew at a remarkable 9.9% compounded annual growth rate over the last five years, higher than its 4.6% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

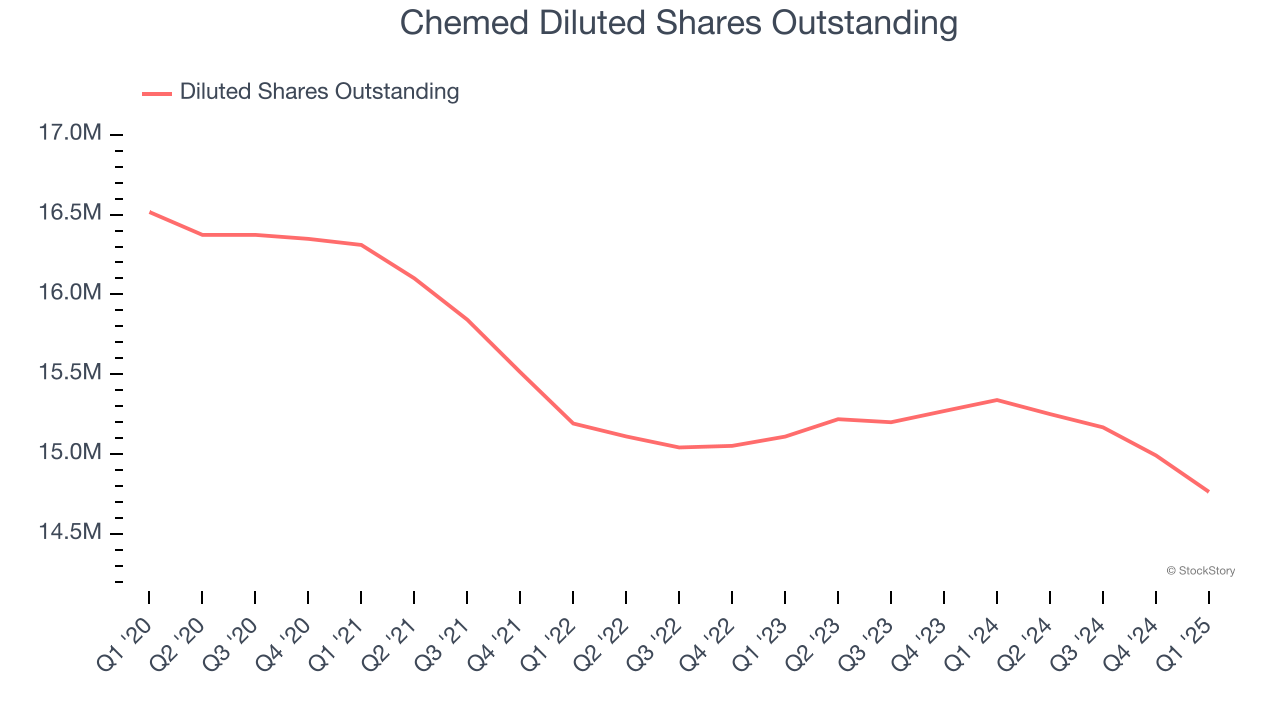

We can take a deeper look into Chemed’s earnings to better understand the drivers of its performance. A five-year view shows that Chemed has repurchased its stock, shrinking its share count by 10.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q1, Chemed reported EPS at $5.63, up from $5.20 in the same quarter last year. This print beat analysts’ estimates by 1.5%. Over the next 12 months, Wall Street expects Chemed’s full-year EPS of $23.57 to grow 9.6%.

Key Takeaways from Chemed’s Q1 Results

It was good to see Chemed top analysts’ revenue, EPS, and EBITDA expectations this quarter. Overall, this quarter had some key positives. The stock remained flat at $590 immediately after reporting.

Is Chemed an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.