Viatris’s stock price has taken a beating over the past six months, shedding 33% of its value and falling to $7.69 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Viatris, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than VTRS and a stock we'd rather own.

Why Do We Think Viatris Will Underperform?

Created through the 2020 merger of Mylan and Pfizer's Upjohn division, Viatris (NASDAQ:VTRS) is a healthcare company that develops, manufactures, and distributes branded and generic medicines across more than 165 countries worldwide.

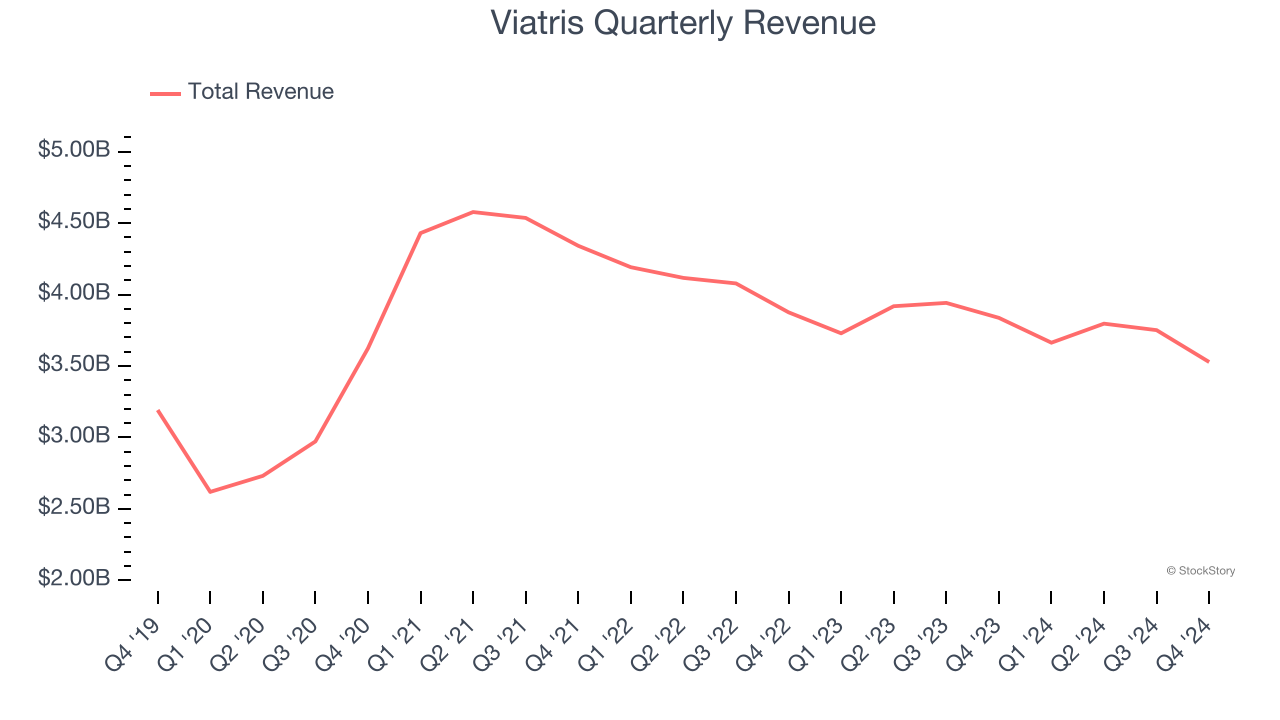

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Viatris’s 5.1% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the healthcare sector.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Viatris’s revenue to drop by 6.4%, a decrease from its 4.8% annualized declines for the past two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

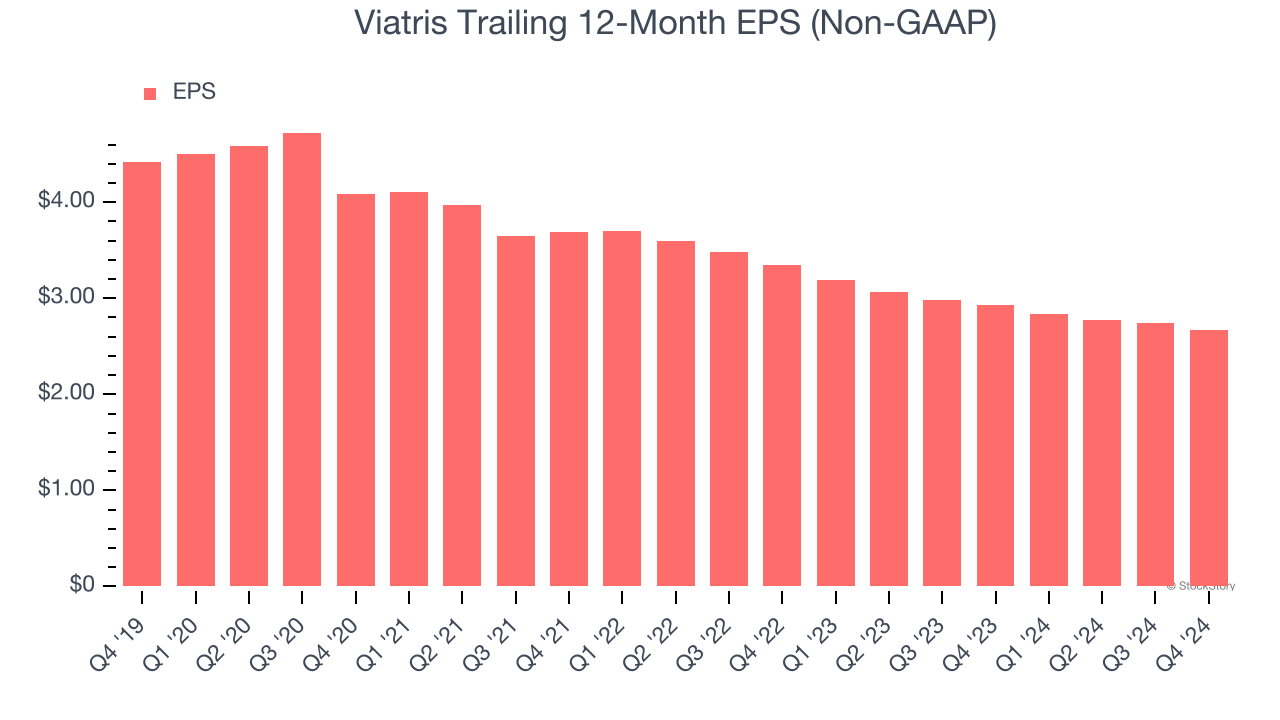

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Viatris, its EPS declined by 9.6% annually over the last five years while its revenue grew by 5.1%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Viatris falls short of our quality standards. Following the recent decline, the stock trades at 3.1× forward price-to-earnings (or $7.69 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Viatris

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.