Security technology and services company ADT (NYSE:ADT) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 4.8% year on year to $1.27 billion. The company expects the full year’s revenue to be around $5.13 billion, close to analysts’ estimates. Its non-GAAP profit of $0.21 per share was 8.9% above analysts’ consensus estimates.

Is now the time to buy ADT? Find out by accessing our full research report, it’s free.

ADT (ADT) Q1 CY2025 Highlights:

- Revenue: $1.27 billion vs analyst estimates of $1.24 billion (4.8% year-on-year growth, 1.9% beat)

- Adjusted EPS: $0.21 vs analyst estimates of $0.19 (8.9% beat)

- Adjusted EBITDA: $661 million vs analyst estimates of $662.8 million (52.2% margin, in line)

- The company reconfirmed its revenue guidance for the full year of $5.13 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $0.81 at the midpoint

- EBITDA guidance for the full year is $2.7 billion at the midpoint, in line with analyst expectations

- Operating Margin: 25.2%, up from 16.2% in the same quarter last year

- Free Cash Flow Margin: 33.3%, up from 7.4% in the same quarter last year

- Market Capitalization: $6.65 billion

“ADT is off to a very solid start in 2025, demonstrating the resilience of our business model, with continued strong cash flow generation and operating profitability. During the quarter, we again delivered a record recurring monthly revenue balance and customer retention, a testament to the strong demand for ADT’s innovative offerings and premium customer experience,” said ADT Chairman, President and CEO, Jim DeVries.

Company Overview

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE:ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

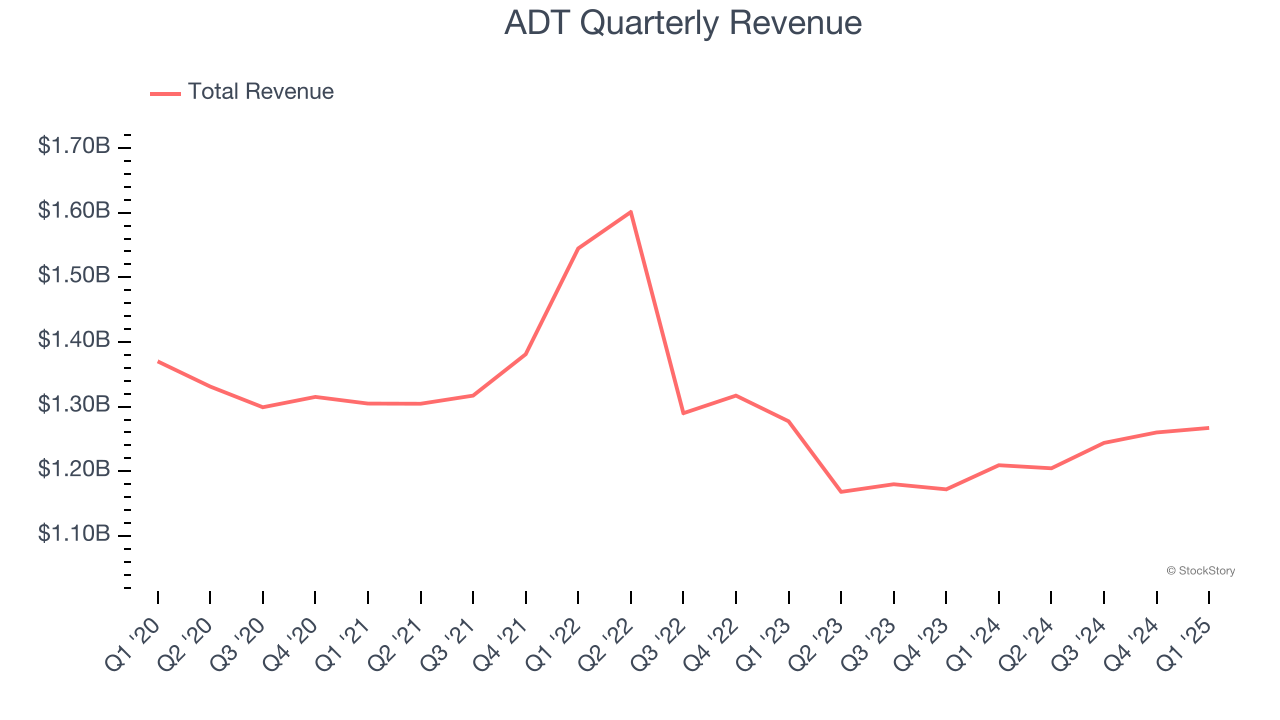

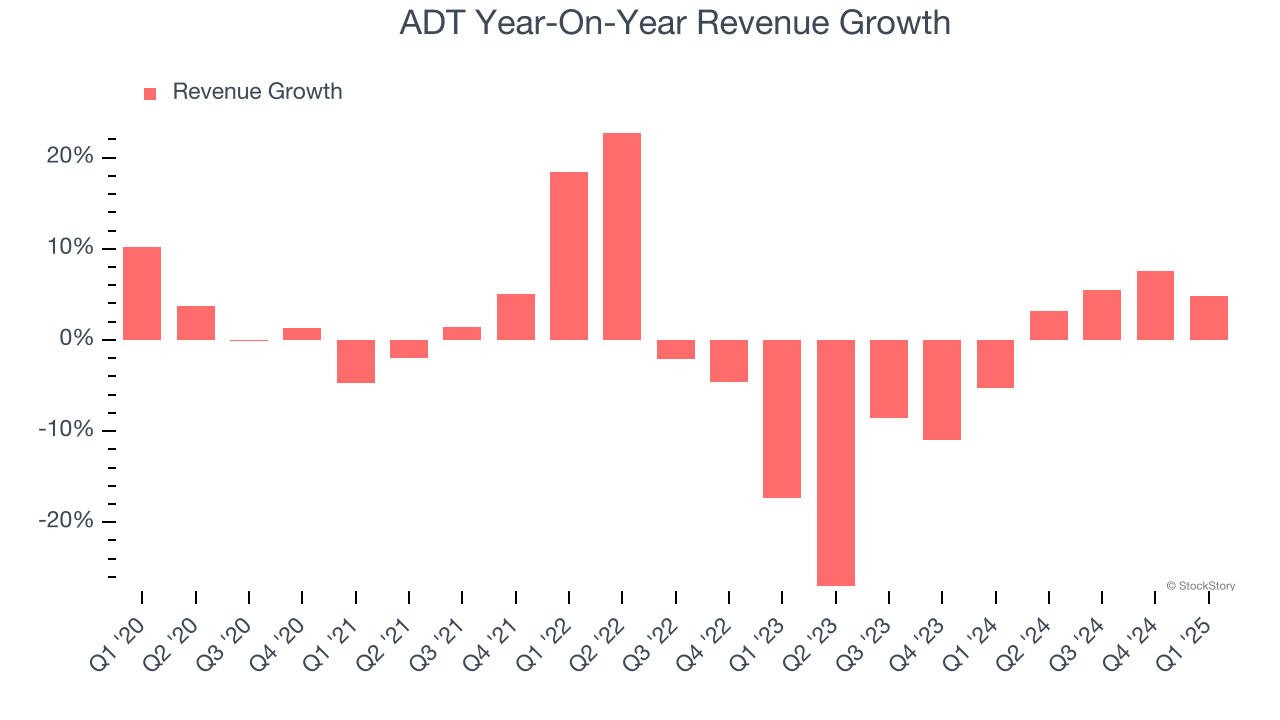

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. ADT struggled to consistently generate demand over the last five years as its sales dropped at a 1.1% annual rate. This wasn’t a great result and is a sign of poor business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. ADT’s recent performance shows its demand remained suppressed as its revenue has declined by 4.8% annually over the last two years.

This quarter, ADT reported modest year-on-year revenue growth of 4.8% but beat Wall Street’s estimates by 1.9%.

Looking ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

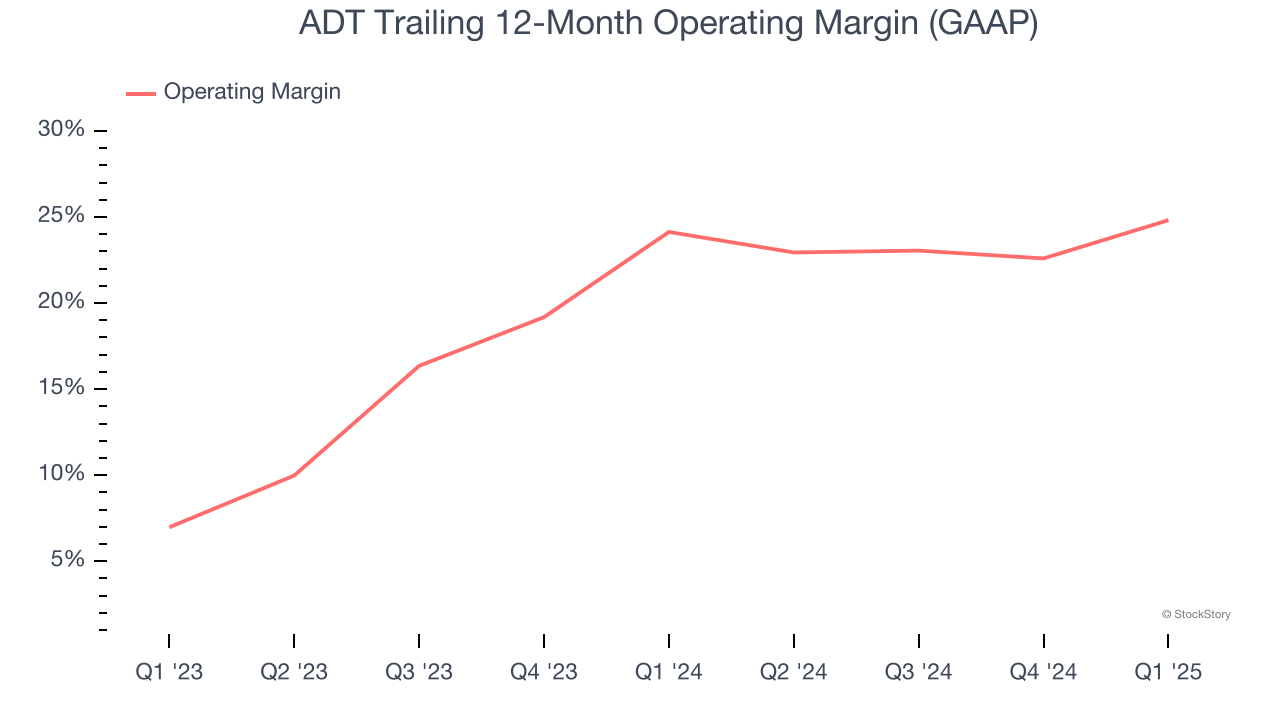

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

ADT’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 24.5% over the last two years. This profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

In Q1, ADT generated an operating profit margin of 25.2%, up 9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

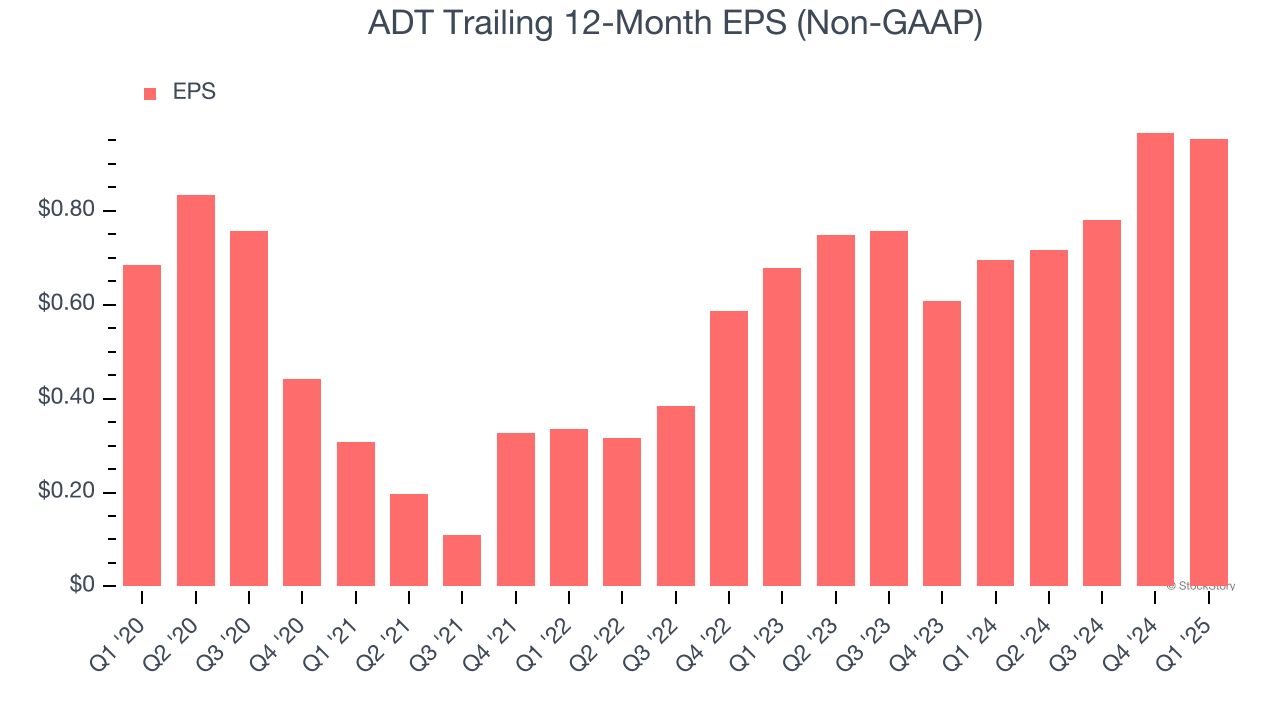

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

ADT’s EPS grew at an unimpressive 6.8% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.1% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

In Q1, ADT reported EPS at $0.21, down from $0.22 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 8.9%. Over the next 12 months, Wall Street expects ADT’s full-year EPS of $0.95 to shrink by 9.5%.

Key Takeaways from ADT’s Q1 Results

It was encouraging to see ADT beat analysts’ revenue and EPS expectations this quarter. Full-year guidance was also maintained. Zooming out, we think this was a decent quarter. The stock remained flat at $7.91 immediately after reporting.

So do we think ADT is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.