Financial services provider CBIZ (NYSE:CBZ) fell short of the market’s revenue expectations in Q1 CY2025, but sales rose 69.5% year on year to $838 million. The company’s full-year revenue guidance of $2.88 billion at the midpoint came in 1.6% below analysts’ estimates. Its non-GAAP profit of $2.29 per share was 8.7% above analysts’ consensus estimates.

Is now the time to buy CBIZ? Find out by accessing our full research report, it’s free.

CBIZ (CBZ) Q1 CY2025 Highlights:

- Revenue: $838 million vs analyst estimates of $860.2 million (69.5% year-on-year growth, 2.6% miss)

- Adjusted EPS: $2.29 vs analyst estimates of $2.11 (8.7% beat)

- Adjusted EBITDA: $237.6 million vs analyst estimates of $219.5 million (28.4% margin, 8.3% beat)

- The company dropped its revenue guidance for the full year to $2.88 billion at the midpoint from $2.93 billion, a 1.7% decrease

- Management reiterated its full-year Adjusted EPS guidance of $3.63 at the midpoint

- EBITDA guidance for the full year is $453 million at the midpoint, in line with analyst expectations

- Operating Margin: 23.9%, up from 22.1% in the same quarter last year

- Free Cash Flow was -$93.23 million compared to -$68.84 million in the same quarter last year

- Market Capitalization: $4.11 billion

"CBIZ delivered positive first-quarter results. As we have demonstrated throughout our history, our operating model enables us to deliver strong earnings and cash flow in varying business climates and our first-quarter financial results are consistent with that history. We are also pleased to report that the Marcum-related integration work is proceeding on schedule, and we continue to experience strong employee and client retention rates and outstanding collaboration within our combined team," said Jerry Grisko, CBIZ President and Chief Executive Officer.

Company Overview

With over 120 offices across 33 states and a team of more than 6,700 professionals, CBIZ (NYSE:CBZ) provides accounting, tax, benefits, insurance brokerage, and advisory services to help small and mid-sized businesses manage their finances and operations.

Business Process Outsourcing & Consulting

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $2.16 billion in revenue over the past 12 months, CBIZ is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

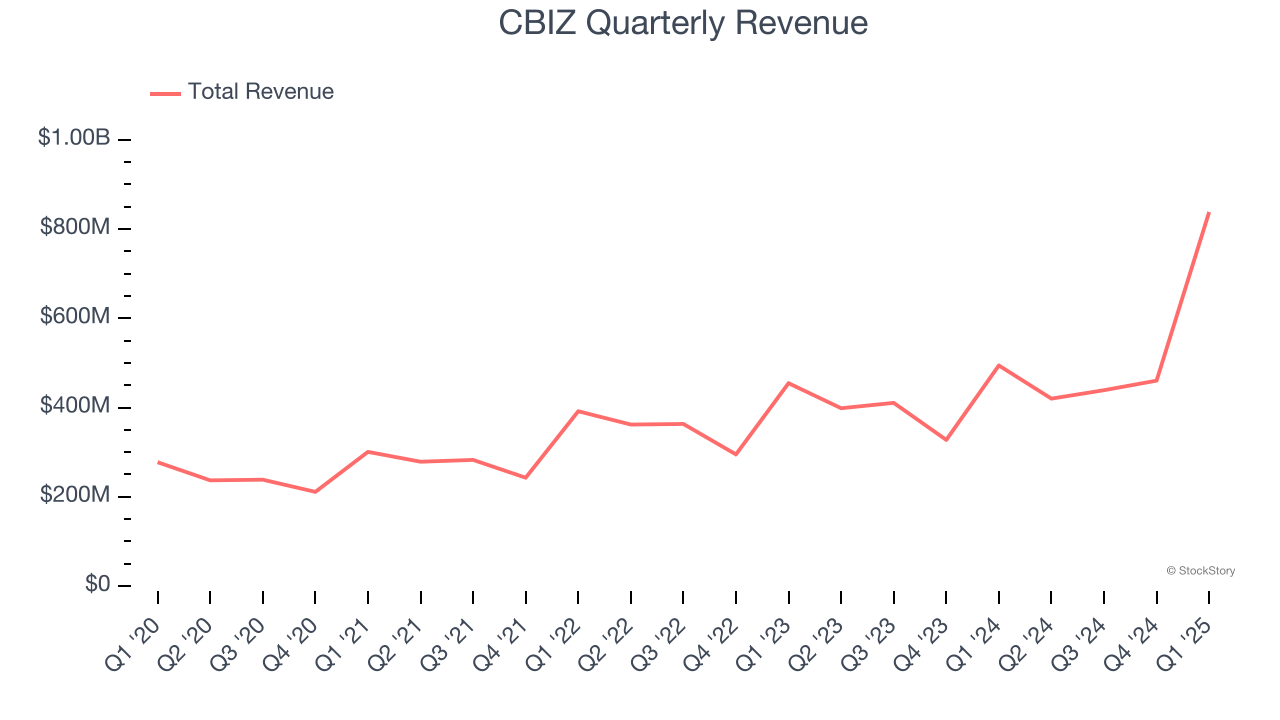

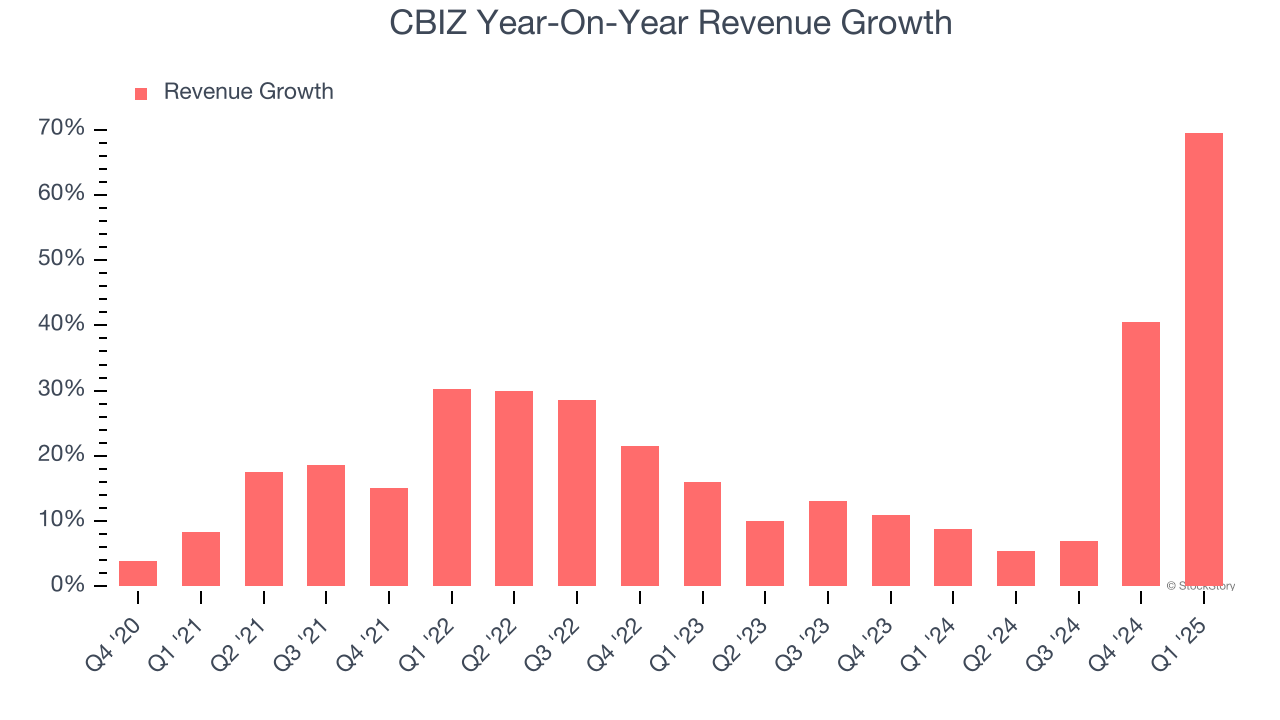

As you can see below, CBIZ grew its sales at an incredible 22% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. CBIZ’s annualized revenue growth of 20.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, CBIZ achieved a magnificent 69.5% year-on-year revenue growth rate, but its $838 million of revenue fell short of Wall Street’s lofty estimates.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

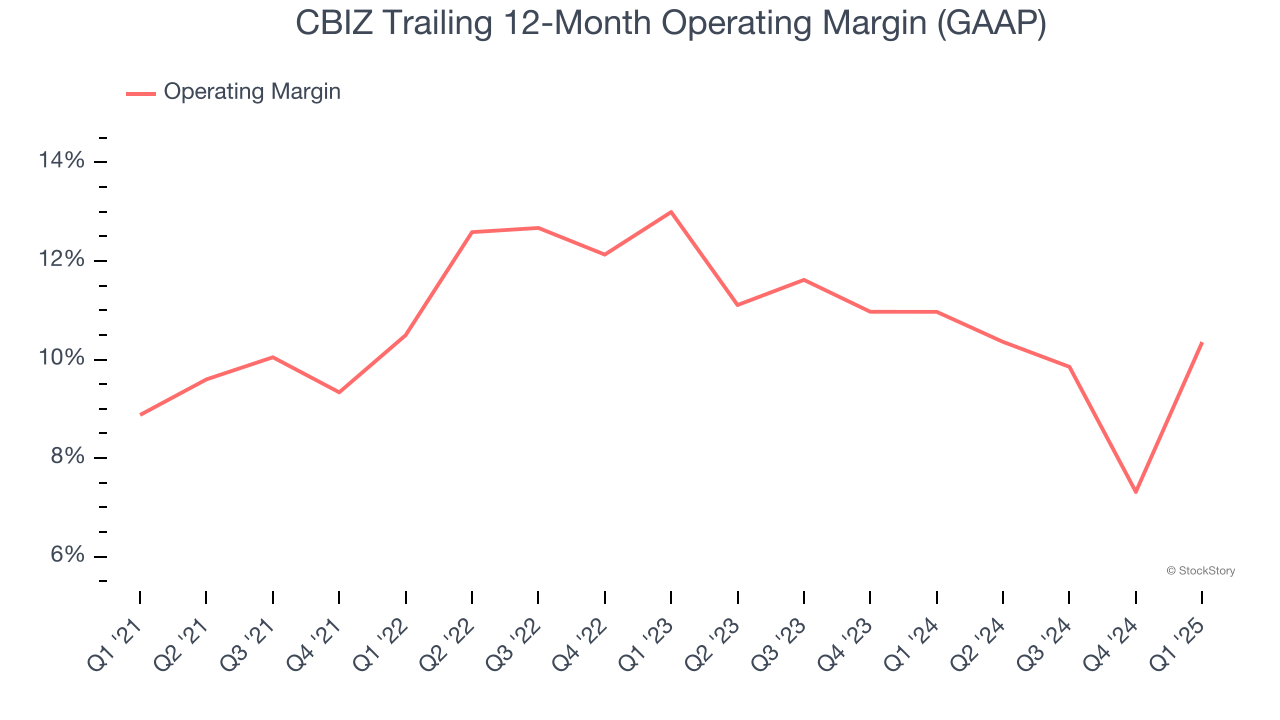

CBIZ has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 10.8%, higher than the broader business services sector.

Analyzing the trend in its profitability, CBIZ’s operating margin rose by 1.5 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q1, CBIZ generated an operating profit margin of 23.9%, up 1.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

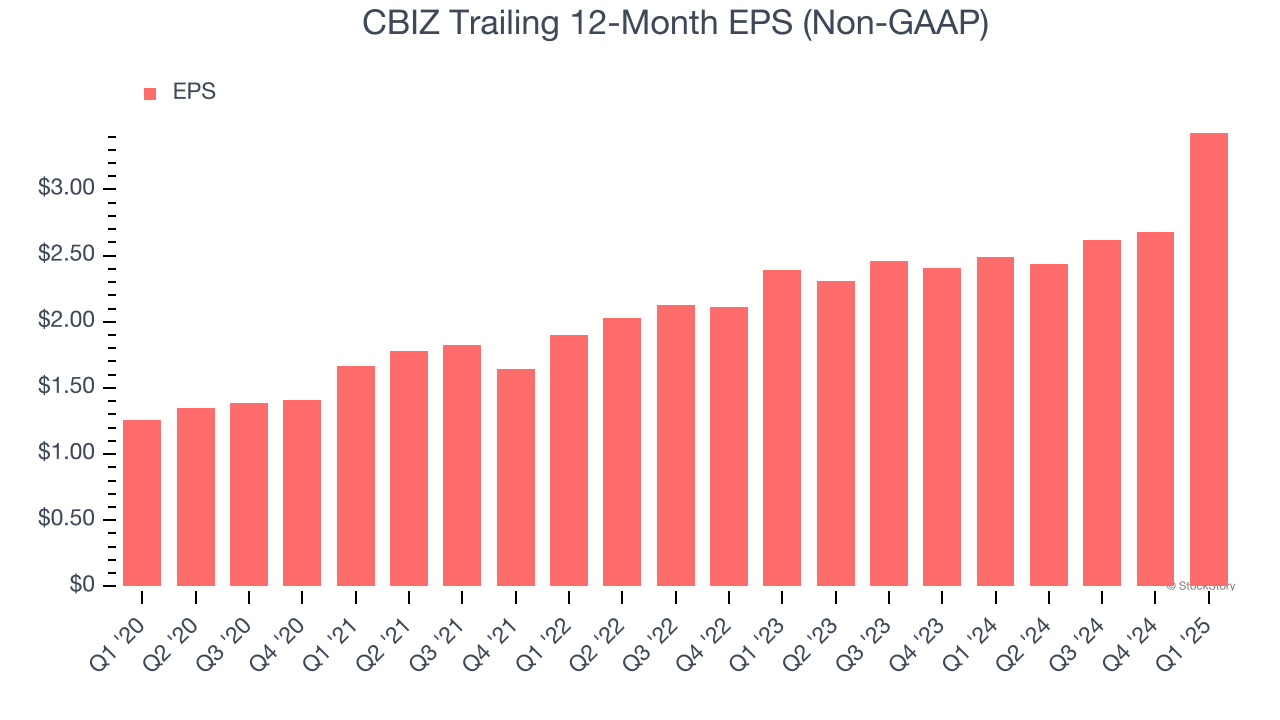

CBIZ’s astounding 22.2% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

In Q1, CBIZ reported EPS at $2.29, up from $1.54 in the same quarter last year. This print beat analysts’ estimates by 8.7%. Over the next 12 months, Wall Street expects CBIZ’s full-year EPS of $3.43 to grow 11.4%.

Key Takeaways from CBIZ’s Q1 Results

We enjoyed seeing CBIZ beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed significantly and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.1% to $74.82 immediately after reporting.

CBIZ may have had a tough quarter, but does that actually create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.