Business advisory firm FTI Consulting (NYSE:FCN) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 3.3% year on year to $898.3 million. Its non-GAAP profit of $2.29 per share was 27.7% above analysts’ consensus estimates.

Is now the time to buy FTI Consulting? Find out by accessing our full research report, it’s free.

FTI Consulting (FCN) Q1 CY2025 Highlights:

- Revenue: $898.3 million vs analyst estimates of $906.8 million (3.3% year-on-year decline, 0.9% miss)

- Adjusted EPS: $2.29 vs analyst estimates of $1.79 (27.7% beat)

- Adjusted EBITDA: $115.2 million vs analyst estimates of $96.19 million (12.8% margin, 19.7% beat)

- Operating Margin: 8.8%, down from 10.7% in the same quarter last year

- Free Cash Flow was -$483 million compared to -$279.5 million in the same quarter last year

- Market Capitalization: $5.95 billion

Steven H. Gunby, President and Chief Executive Officer of FTI Consulting, commented, “This is a time of disruption for many of our clients; as they assess their risks and opportunities, many of them are finding the depth and breadth of our capabilities across our global platform to be a reason to turn to us.”

Company Overview

With a team of experts deployed across 30+ countries to tackle complex business challenges, FTI Consulting (NYSE:FCN) is a global business advisory firm that helps organizations manage change, mitigate risk, and resolve disputes across financial, legal, operational, and regulatory matters.

Business Process Outsourcing & Consulting

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $3.67 billion in revenue over the past 12 months, FTI Consulting is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

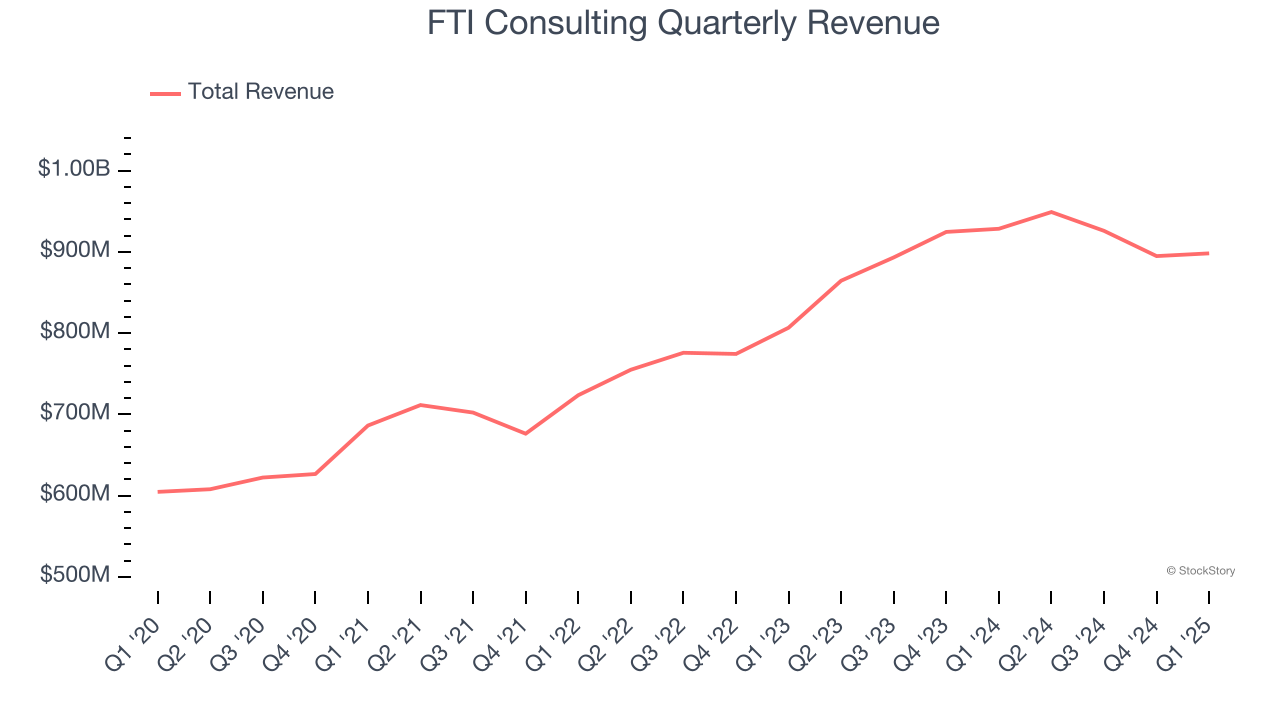

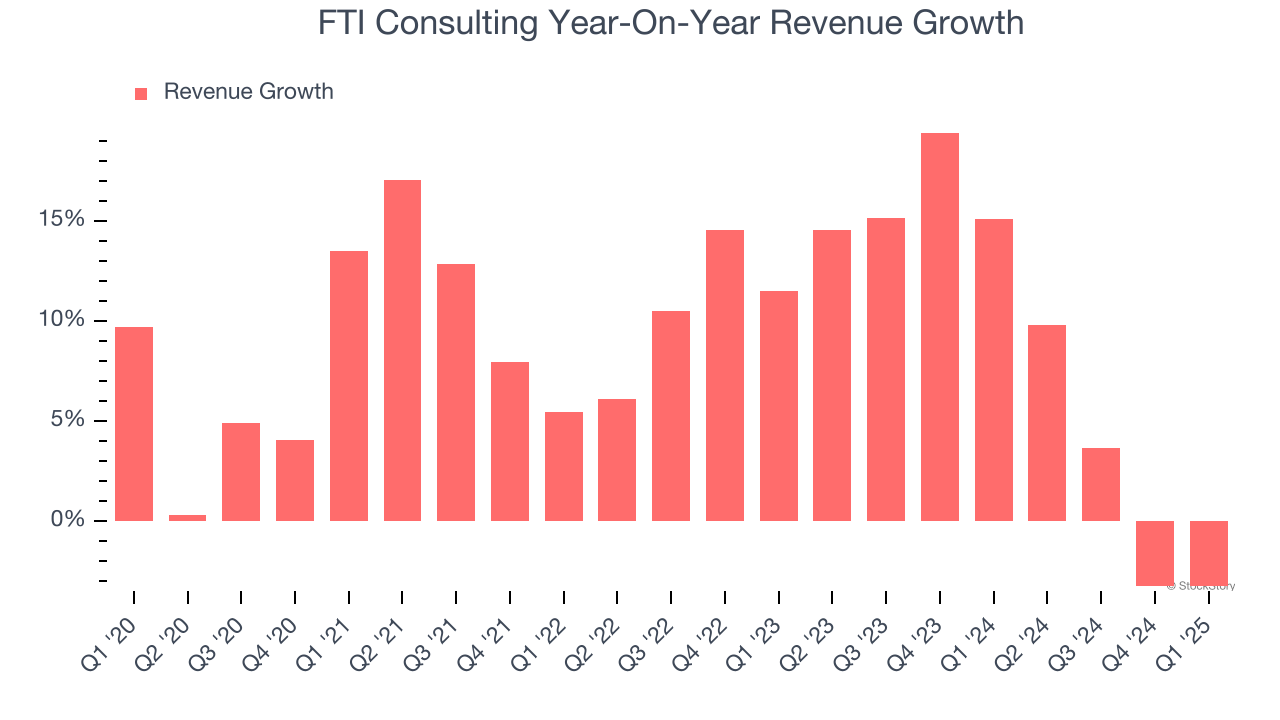

As you can see below, FTI Consulting’s 8.8% annualized revenue growth over the last five years was solid. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. FTI Consulting’s annualized revenue growth of 8.6% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, FTI Consulting missed Wall Street’s estimates and reported a rather uninspiring 3.3% year-on-year revenue decline, generating $898.3 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

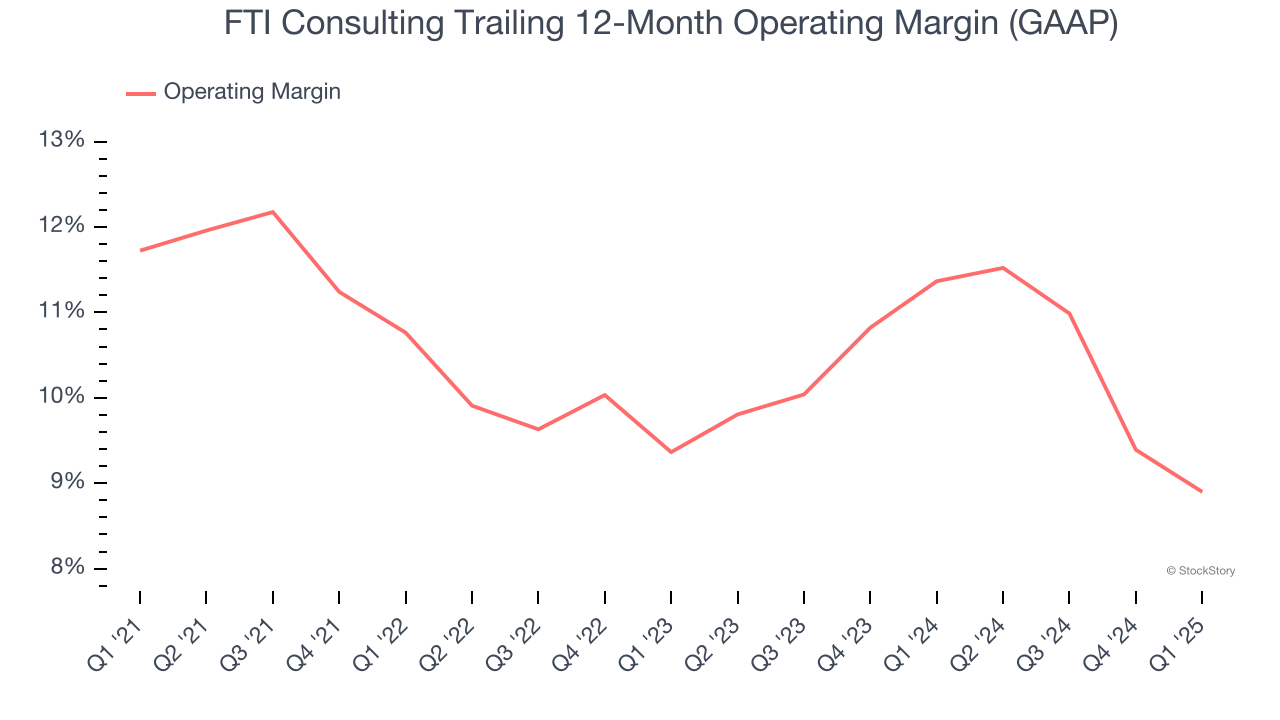

FTI Consulting has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 10.3%, higher than the broader business services sector.

Analyzing the trend in its profitability, FTI Consulting’s operating margin decreased by 2.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q1, FTI Consulting generated an operating profit margin of 8.8%, down 2 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

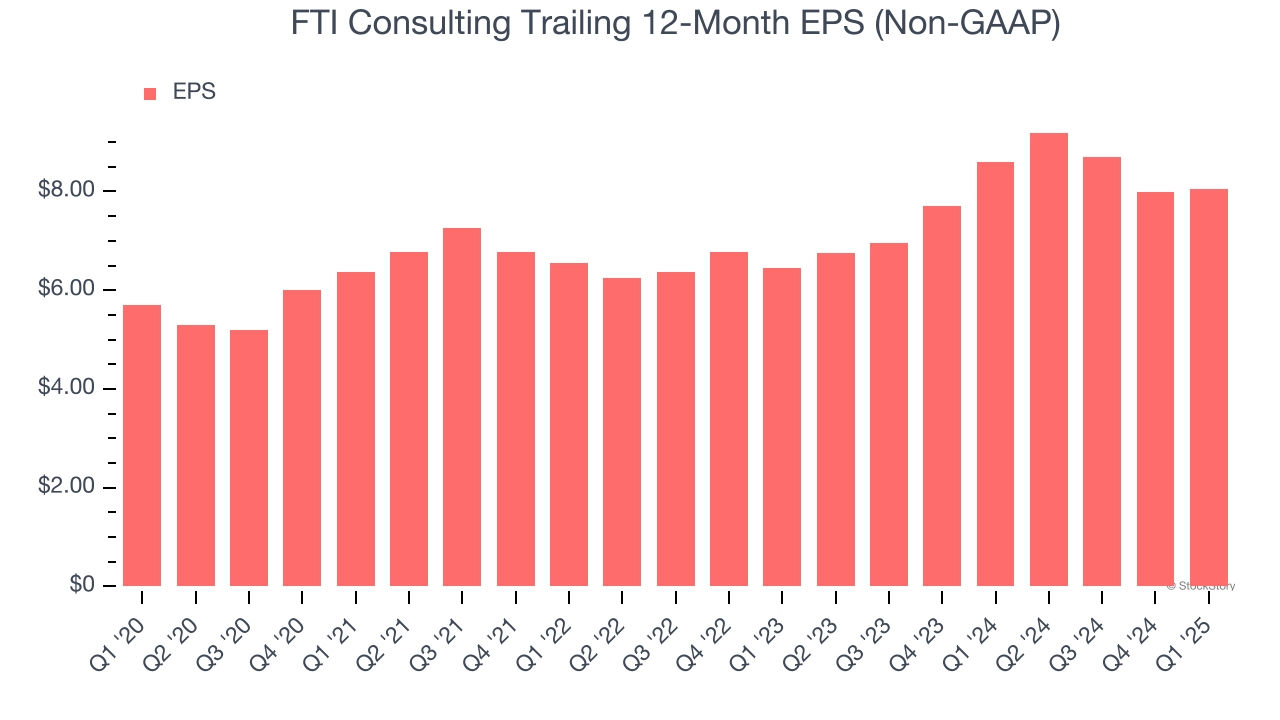

FTI Consulting’s EPS grew at an unimpressive 7.1% compounded annual growth rate over the last five years, lower than its 8.8% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of FTI Consulting’s earnings can give us a better understanding of its performance. As we mentioned earlier, FTI Consulting’s operating margin declined by 2.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, FTI Consulting reported EPS at $2.29, up from $2.23 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects FTI Consulting’s full-year EPS of $8.04 to stay about the same.

Key Takeaways from FTI Consulting’s Q1 Results

We were impressed by how significantly FTI Consulting blew past analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue slightly missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.5% to $170.89 immediately following the results.

Sure, FTI Consulting had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.