Global pharmaceutical company Merck (NYSE:MRK) beat Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 1.6% year on year to $15.53 billion. The company expects the full year’s revenue to be around $64.85 billion, close to analysts’ estimates. Its non-GAAP profit of $2.22 per share was 4% above analysts’ consensus estimates.

Is now the time to buy Merck? Find out by accessing our full research report, it’s free.

Merck (MRK) Q1 CY2025 Highlights:

- Revenue: $15.53 billion vs analyst estimates of $15.29 billion (1.6% year-on-year decline, 1.6% beat)

- Adjusted EPS: $2.22 vs analyst estimates of $2.14 (4% beat)

- The company reconfirmed its revenue guidance for the full year of $64.85 billion at the midpoint

- Operating Margin: 61.5%, up from 35.7% in the same quarter last year

- Constant Currency Revenue rose 1% year on year (12% in the same quarter last year)

- Market Capitalization: $198.1 billion

“Our company made strong progress to start the year, with increasing contributions from our newer commercialized medicines and vaccines and continued advancement of our pipeline,” said Robert M. Davis, Chairman and CEO, Merck.

Company Overview

With roots dating back to 1891 and a portfolio that includes the blockbuster cancer immunotherapy Keytruda, Merck (NYSE:MRK) develops and sells prescription medicines, vaccines, and animal health products across oncology, infectious diseases, cardiovascular, and other therapeutic areas.

Branded Pharmaceuticals

The branded pharmaceutical industry relies on a high-cost, high-reward business model, driven by substantial investments in research and development to create innovative, patent-protected drugs. Successful products can generate significant revenue streams over their patent life, and the larger a roster of drugs, the stronger a moat a company enjoys. However, the business model is inherently risky, with high failure rates during clinical trials, lengthy regulatory approval processes, and intense competition from generic and biosimilar manufacturers once patents expire. These challenges, combined with scrutiny over drug pricing, create a complex operating environment. Looking ahead, the industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Sales Growth

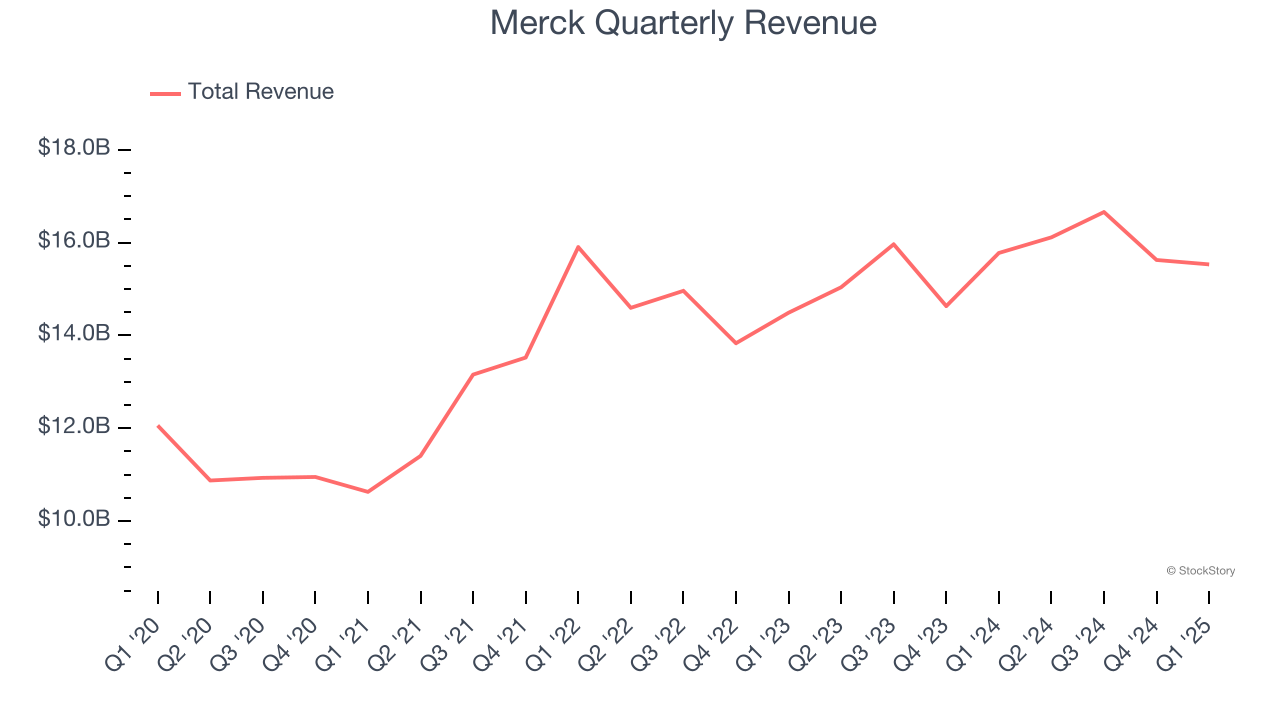

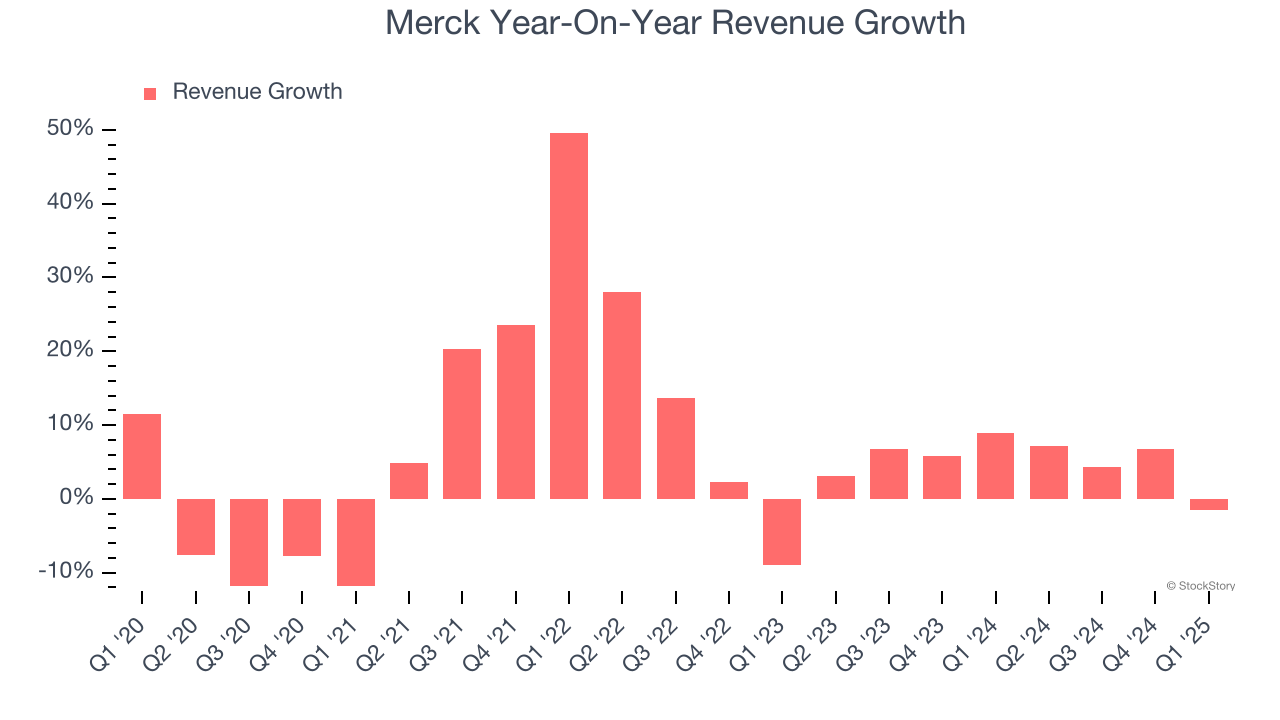

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Merck grew its sales at a mediocre 5.9% compounded annual growth rate. This wasn’t a great result compared to the rest of the healthcare sector, but there are still things to like about Merck.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Merck’s annualized revenue growth of 5.1% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

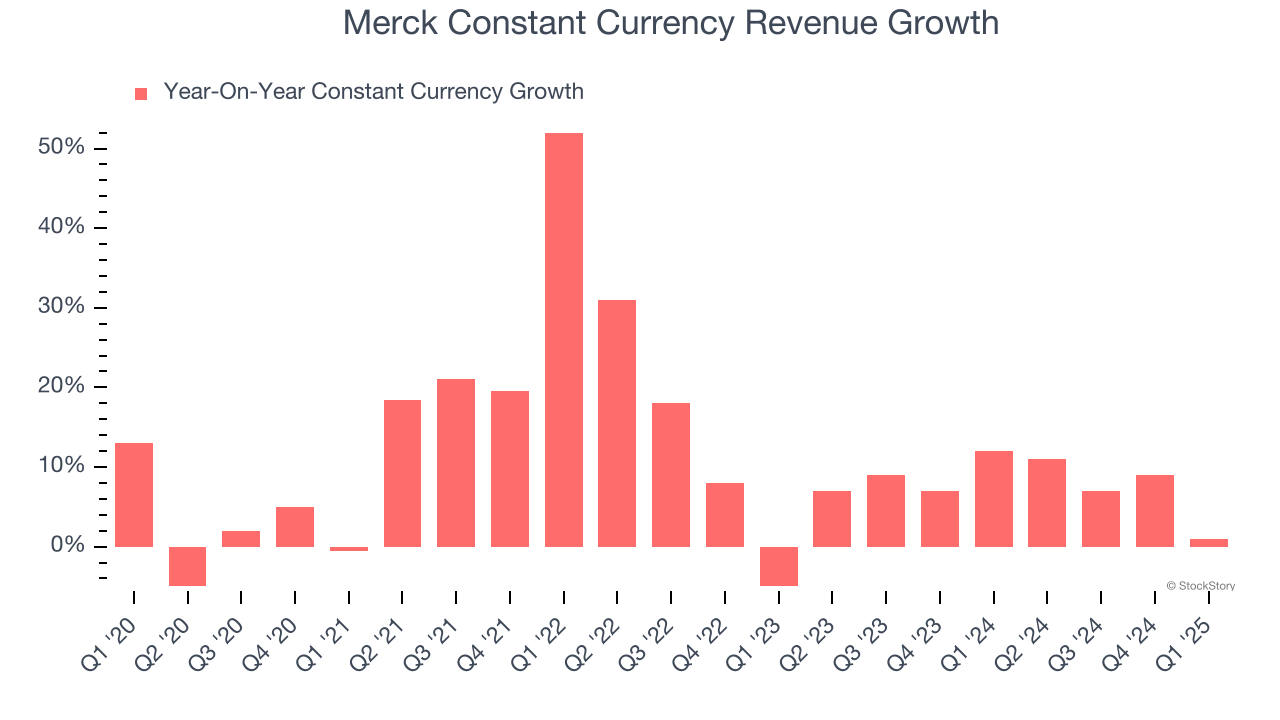

Merck also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 7.9% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Merck.

This quarter, Merck’s revenue fell by 1.6% year on year to $15.53 billion but beat Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

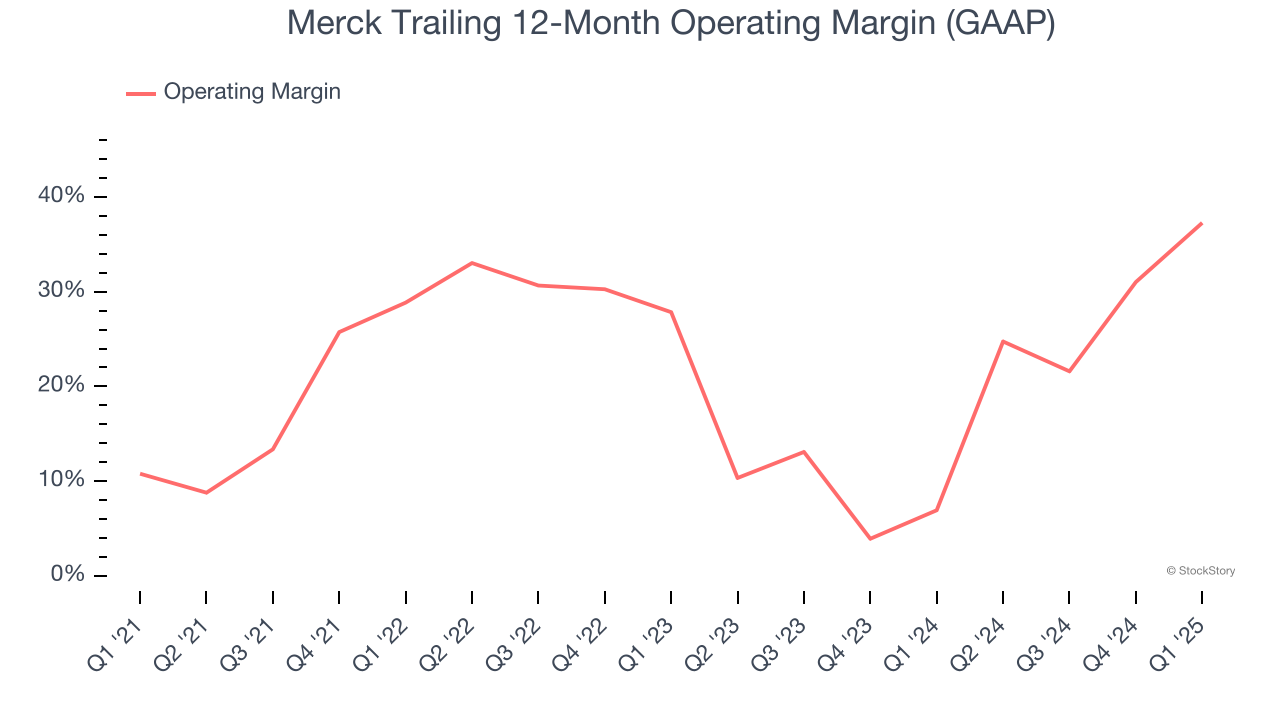

Merck has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 23%.

Analyzing the trend in its profitability, Merck’s operating margin rose by 26.5 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 9.4 percentage points on a two-year basis.

This quarter, Merck generated an operating profit margin of 61.5%, up 25.8 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

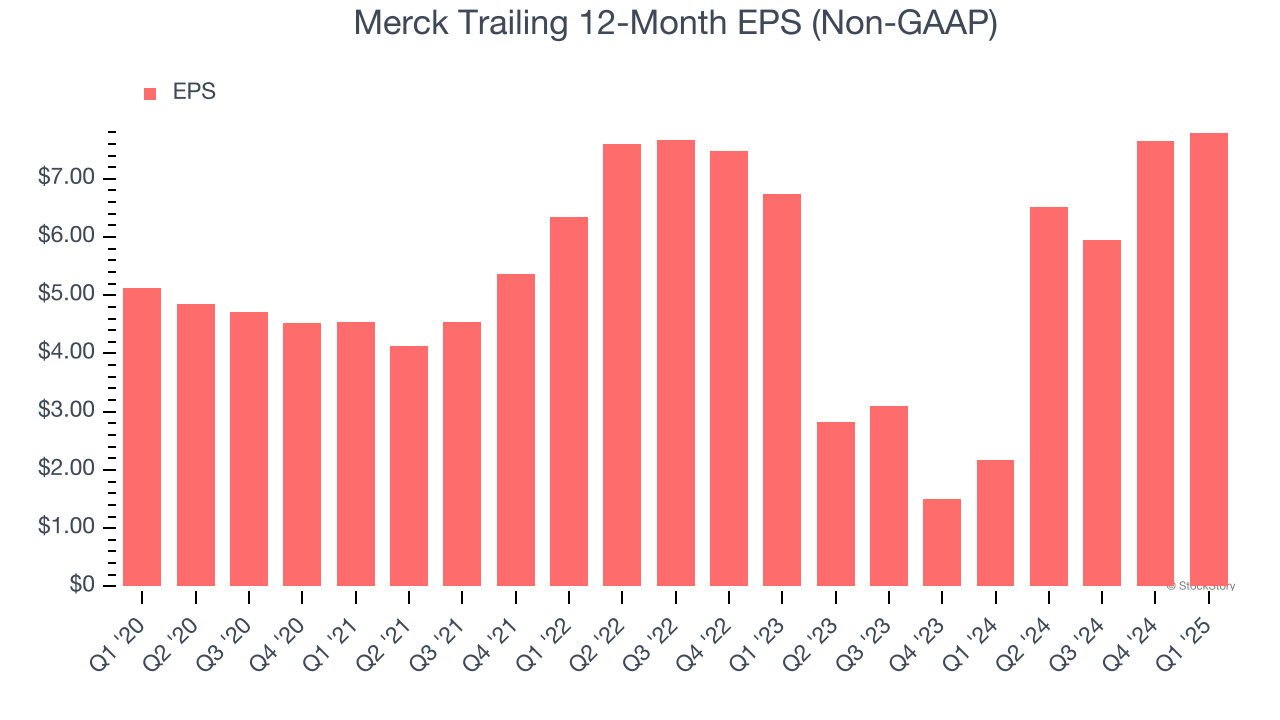

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Merck’s EPS grew at a solid 8.8% compounded annual growth rate over the last five years, higher than its 5.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Merck’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Merck’s operating margin expanded by 26.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Merck reported EPS at $2.22, up from $2.08 in the same quarter last year. This print beat analysts’ estimates by 4%. Over the next 12 months, Wall Street expects Merck’s full-year EPS of $7.79 to grow 16.4%.

Key Takeaways from Merck’s Q1 Results

We were impressed by how significantly Merck blew past analysts’ constant currency revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.3% to $79.73 immediately after reporting.

Indeed, Merck had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.